Small businesses face growing cyber threats, but many struggle to decide if cyber insurance is worth the investment.

At Project IT, we’ve seen firsthand how devastating cyberattacks can be for small companies.

This post explores the pros and cons of cyber insurance for small businesses, helping you make an informed decision about protecting your digital assets.

What Is Cyber Insurance for Small Businesses?

The Essentials of Cyber Insurance Coverage

Cyber insurance provides specialised protection for businesses against financial losses from digital threats. For small businesses, it serves as a critical shield against the potentially ruinous costs of cyber incidents.

Typical cyber insurance policies cover expenses related to:

- Data recovery and system restoration

- Legal fees and regulatory fines

- Customer notification and credit monitoring

- Public relations efforts to manage reputational damage

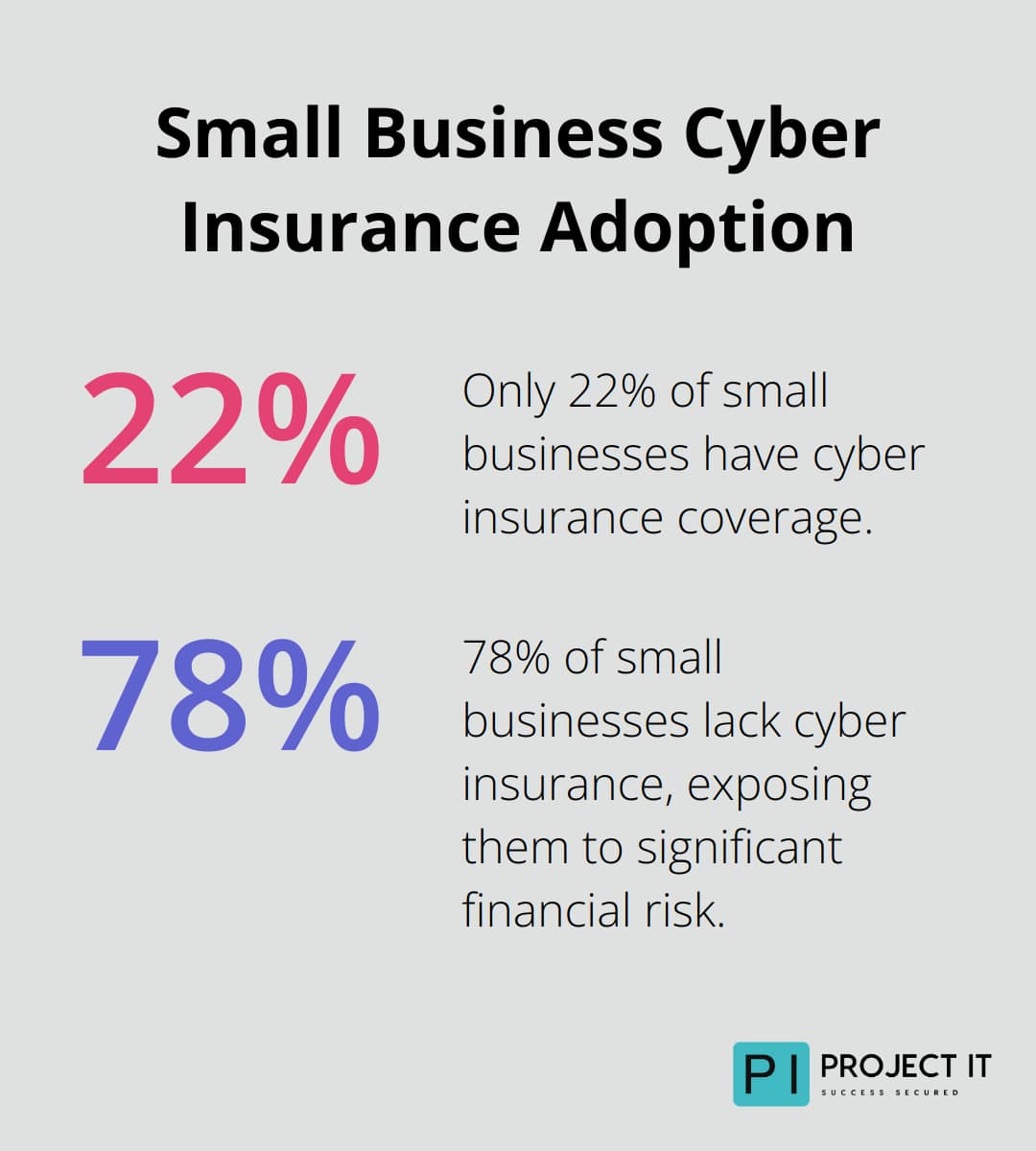

A 2023 report by the National Association of Insurance Commissioners reveals that only 22% of small businesses have cyber insurance. This statistic exposes a significant vulnerability among small businesses to financial devastation in the event of a cyber attack.

Cyber Threats Targeting Small Businesses

Small businesses often face more frequent cyber threats than larger corporations. The Verizon 2023 Data Breach Investigations Report highlights that 95% were financially motivated. Common threats include:

- Phishing attacks: Deceptive emails or websites that trick employees into revealing sensitive information.

- Ransomware: Malicious software that encrypts data and demands payment for its release.

- Data breaches: Unauthorised access to sensitive customer or business information.

- Social engineering: Manipulation of employees to gain access to systems or data.

Dispelling Cyber Insurance Myths

Many small business owners hold misconceptions about cyber insurance that prevent them from obtaining adequate coverage. Let’s address some common myths:

Myth 1: “We’re too small to be targeted.”Reality: Cybercriminals often view small businesses as easy targets due to potentially weaker security measures.

Myth 2: “Our general liability insurance covers cyber incidents.”Reality: Standard business insurance policies typically exclude cyber-related losses.

Myth 3: “Cyber insurance costs too much for small businesses.”Reality: The cost of cyber insurance often pales in comparison to the potential financial impact of a cyber incident. A study by the Ponemon Institute found that the average cost of a data breach for small businesses hovers around $200,000.

The Role of Cyber Insurance in Risk Management

Cyber insurance plays a vital role in a comprehensive risk management strategy. While it doesn’t replace robust cybersecurity measures, it provides an essential safety net for small businesses.

Insurance policies (when properly tailored to a business’s needs) can offer financial protection and access to expert resources in the event of a cyber incident. This support can prove invaluable for small businesses that may lack the internal expertise or resources to handle a major cyber attack.

As cyber threats continue to evolve and target businesses of all sizes, the importance of cyber insurance grows. Small business owners must weigh the potential costs of a cyber incident against the investment in a comprehensive cyber insurance policy.

In the next section, we’ll explore the specific advantages that cyber insurance offers to small businesses, helping you understand how this coverage can protect your company’s financial health and reputation.

Why Cyber Insurance Is a Game-Changer for Small Businesses

At Project IT, we’ve witnessed how cyber insurance can be a lifeline for small businesses. This coverage isn’t just another expense-it’s a strategic investment that can save your company from financial ruin.

Financial Safeguard Against Cyber Disasters

Cyber insurance acts as a financial buffer, protecting your business from the potentially crippling costs of a data breach. According to recent data, the average cost of a data breach for businesses with 500-1,000 employees was $2.63 million, while it jumped to $4.09 million for larger businesses. For small businesses, such an expense could be catastrophic.

A robust cyber insurance policy covers a range of expenses, including:

- Data recovery and system restoration costs

- Customer notification expenses

- Credit monitoring services for affected individuals

- Business interruption losses

These costs can quickly add up, but with the right coverage, you won’t foot the entire bill.

Legal and Regulatory Protection

In the aftermath of a cyber incident, legal and regulatory challenges often follow. Cyber insurance provides crucial coverage for legal fees and potential fines. This is particularly important given the complex regulatory landscape surrounding data protection.

For instance, under the General Data Protection Regulation (GDPR), companies can face fines of up to €20 million or 4% of annual global turnover (whichever is higher). Cyber insurance can help mitigate these potentially business-ending penalties.

Expert Support When You Need It Most

One of the most valuable aspects of cyber insurance is the access it provides to incident response teams and cybersecurity experts. These professionals can guide your business through the crisis, helping to minimise damage and accelerate recovery.

Insurance providers often have established relationships with top-tier cybersecurity firms, giving you access to resources that might otherwise be out of reach for a small business. This support can help you navigate the complex process of incident response, from initial containment to system restoration and regulatory compliance.

Comprehensive Risk Management

Cyber insurance plays a vital role in a comprehensive risk management strategy. While it doesn’t replace robust cybersecurity measures, it provides an essential safety net for small businesses. Insurance policies (when properly tailored to a business’s needs) can offer financial protection and access to expert resources in the event of a cyber incident.

This support can prove invaluable for small businesses that may lack the internal expertise or resources to handle a major cyber attack. As cyber threats continue to evolve and target businesses of all sizes, the importance of cyber insurance grows.

The Hidden Benefits of Cyber Insurance

Beyond the obvious financial protection, cyber insurance offers several hidden benefits:

While the benefits of cyber insurance are clear, it’s important to consider potential drawbacks as well. In the next section, we’ll explore some of the challenges and limitations associated with cyber insurance for small businesses.

The Hidden Costs of Cyber Insurance

The Price Tag of Protection

Cyber insurance premiums can significantly impact small businesses’ budgets. According to a report published by Advisor Smith, the average U.S. business spent $132 on cyber insurance. These costs vary based on factors like industry, revenue, and cybersecurity measures.

Many small businesses struggle to justify this expense, especially when balancing it against other pressing needs. However, the potential cost of a cyber incident without insurance could prove far more devastating.

The Fine Print Dilemma

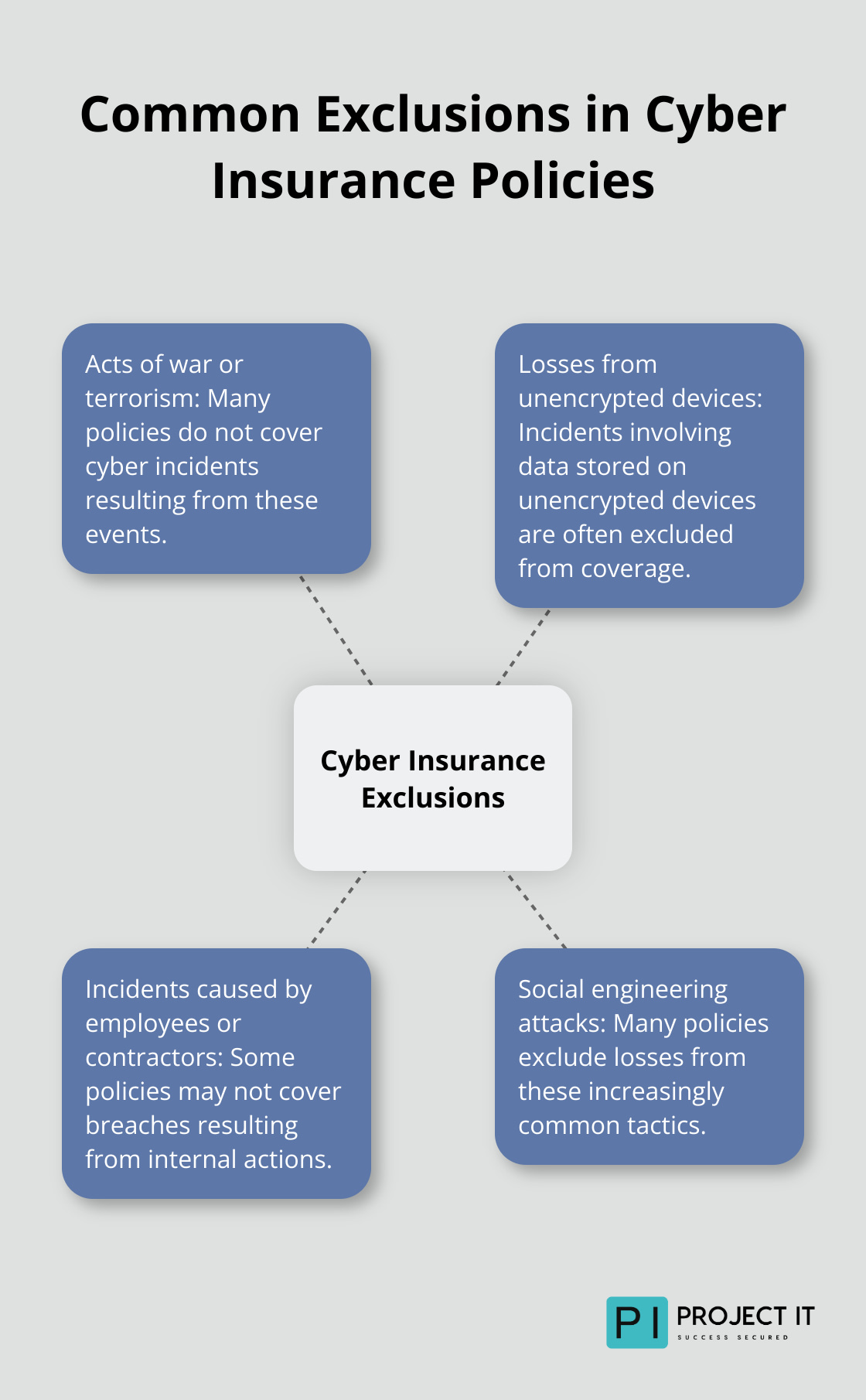

Cyber insurance policies often contain complex exclusions and limitations that can leave businesses exposed. For example, many policies don’t cover losses from social engineering attacks (which accounted for 43% of all breaches in 2023, according to the Verizon Data Breach Investigations Report).

Other common exclusions include:

These coverage gaps can lead to unpleasant surprises when you need your insurance most. A thorough review and understanding of your policy is essential to avoid these pitfalls.

Navigating the Coverage Maze

Selecting the right cyber insurance coverage presents a challenge for small businesses. The rapidly evolving nature of cyber threats makes it difficult to determine the appropriate level and type of coverage.

Many small business owners find themselves overwhelmed by technical jargon and struggle to assess their risk accurately. This complexity can result in either under-insuring (leaving your business vulnerable) or over-insuring (wasting valuable resources).

The decision-making process often requires a deep understanding of both business operations and the current cyber threat landscape – knowledge that many small business owners lack the time or resources to develop.

The False Security Trap

One of the most insidious drawbacks of cyber insurance is the false sense of security it can create. Some businesses mistakenly view cyber insurance as a substitute for robust cybersecurity measures.

This mindset can lead to neglect of essential security practices, ironically increasing the likelihood of a cyber incident. Cyber insurance should serve as a safety net, not your primary line of defence.

Many insurers now require businesses to implement specific security measures before providing coverage, such as:

- Regular security awareness training for employees

- Implementation of multi-factor authentication

- Regular software updates and patch management

- Endpoint detection and response (EDR) solutions

While these measures benefit your overall security posture, they represent additional costs and efforts that you must factor into your cyber insurance decision.

The Complexity of Claims

Filing a cyber insurance claim can prove challenging and time-consuming. Cyber insurance claims statistics reveal that 9% of cyber insurance claims during the 2019-2021 period were for privacy breach among other reasons.

Additionally, the claims process may involve complex negotiations with the insurer, potentially leading to disputes over coverage and payouts. This complexity can delay your business’s recovery and add stress during an already difficult time.

Small businesses must carefully weigh these hidden costs against the potential benefits of cyber insurance to determine if it’s truly worth the investment for their specific situation.

Final Thoughts

Cyber insurance offers financial protection and expert support for small businesses, but it comes with premium costs and policy limitations. Small businesses must evaluate their specific risk profile, including the type of sensitive data they handle and their industry’s regulatory requirements. A thorough risk assessment will help determine the potential impact of a cyber incident on operations and finances.

Cyber insurance should complement strong cybersecurity practices, not replace them. Implementing robust security measures reduces the risk of cyber incidents and can lead to lower insurance premiums. These measures include employee training, multi-factor authentication, and regular software updates.

For many small businesses, a combination of cyber insurance and proactive security measures provides the best protection. This approach safeguards finances while reducing the likelihood of successful attacks. Project IT recommends a comprehensive strategy that includes both insurance and strong cybersecurity practices to protect your digital assets in today’s business landscape.